Most of us are familiar with environmental, social, and governance (ESG) standards; more importantly, we support them. And why wouldn't we? After all, society is more concerned than ever about environmental and social issues, but do we really apply them through our investments?

Aligning our investments with our values is all about understanding where we are putting our money and deciding whether those investments represent what we stand for. Choosing to invest in ESG companies is how we reaffirm our convictions about product quality, employee rights, transparency, climate change, and other social issues.

In addition, paying careful attention to the ESG criteria of the companies we invest in is key because ESG is an integral aspect of risk assessment, so we should be doing it anyway as part of our investment analysis. If we don't have the time and patience to evaluate our investments holistically, we might as well pay someone else to do it.

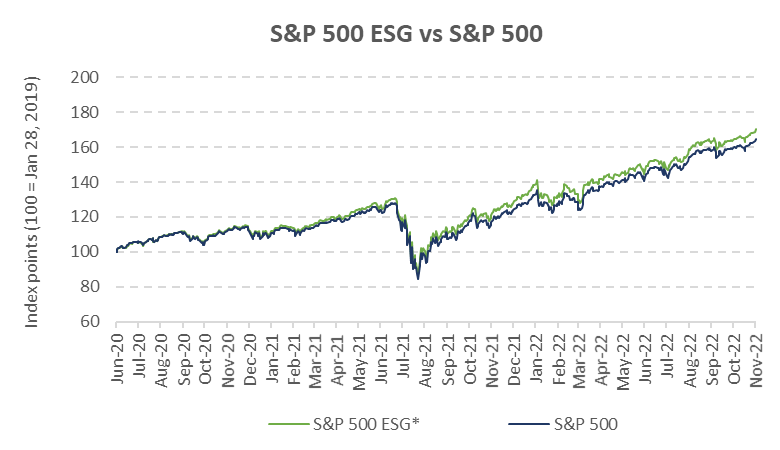

Moreover, companies with high ESG scores have consistently outperformed the rest in recent years. This can be seen in the following graph that compares the S&P 500 index with the S&P 500 ESG index.

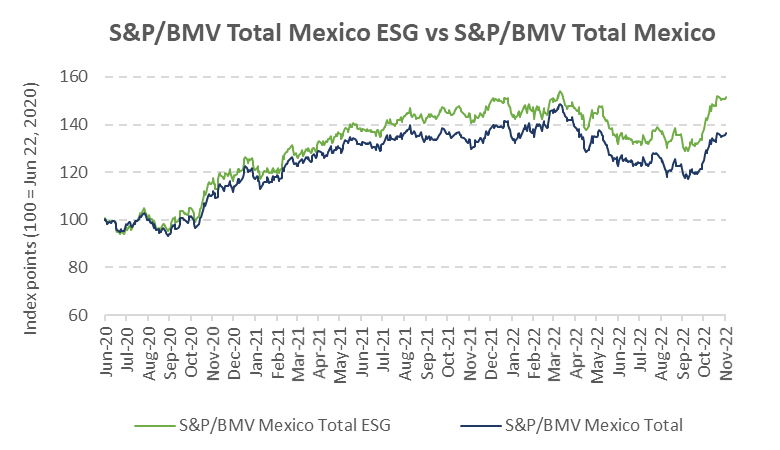

When performing the same exercise for the Mexican emerging market, which launched its ESG index on June 22, 2020, the outperformance of the ESG index versus the S&P/BMV Total Mexico is even higher.

When performing the same exercise for the Mexican emerging market, which launched its ESG index on June 22, 2020, the outperformance of the ESG index versus the S&P/BMV Total Mexico is even higher.

Here are some tips to start applying ESG standards in investment decisions:

- If we invest in individual stocks, we can consult the ESG reports of those companies, which contain information on policies, procedures, diversity, and initiatives related to E&S and corporate governance.

- We can go further and search the media for negative and positive news about executives, board members, and shareholders.

- We can also follow the companies we invest in (or are considering investing in) on LinkedIn or other social media to stay abreast of corporate sustainability initiatives.

- If we prefer to invest in indexes or exchange-traded funds (ETFs), we may want to examine all available ESG options and their selection criteria. The S&P 500 ESG is just one of many indexes available with an ESG focus. Other ESG indexes, while less liquid, can offer the prospect of great returns.

- For passive investors, it is advisable to have conversations with asset managers to learn whether they are evaluating ESG standards and incorporating them into their asset selection and, if not, to encourage them to start doing so.

Of course, ESG is not the only variable to consider. Let’s remember that return on equity is derived from the difference between what we paid versus the real value of the assets. Nevertheless, ESG consideration is an excellent strategy for risk management, social value creation, the prospect of higher returns, and, most importantly, alignment between our investments and our values.