Thanks to their strong performance over the last year, emerging market stocks have attracted renewed interest from global investors - and emerging market ETFs are one of the simplest ways to gain exposure to them. ETFs allow investors to participate in the growth stories of countries undergoing economic transformation.

Emerging market ETFs invest in companies or assets based in emerging countries such as China, India, Russia, amongst others.

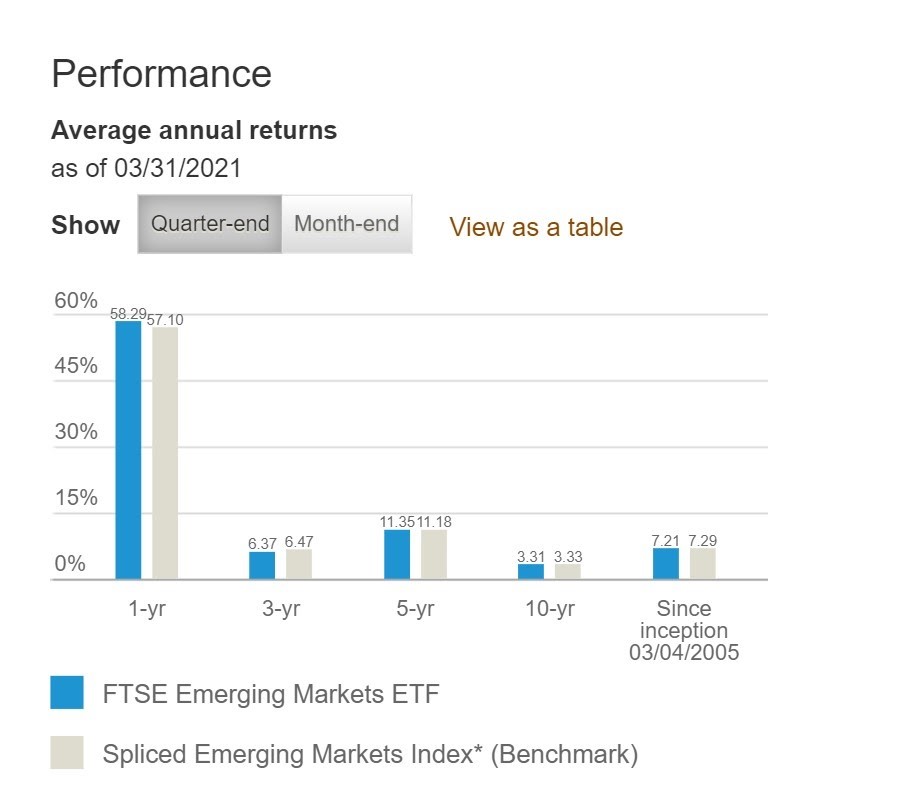

Take a quick look at the one-year performance of the Vanguard FTSE Emerging Markets ETF - it returned a staggering 58% for the year ending March 31, 2021. Pretty tasty, right?

Benefits of Investing in Emerging Market Equities

Benefits of Investing in Emerging Market Equities

By investing in emerging markets, you get both securities diversification and currency diversification.

The stocks and other assets held by an emerging market ETF are denominated in local currency, not in US dollars.

If you believe the US dollar is going to weaken further against emerging market currencies, you could invest in emerging market ETFs to enjoy an additional upside due to currency diversification.

Furthermore, emerging market ETFs give you the opportunity to improve the long-term returns of your portfolio.

According to the International Monetary Fund (IMF), emerging markets and developing economies account for 80% of global economic growth. Emerging markets are expected to remain the biggest drivers of growth in years to come.

A Word of Caution

Even though they are experiencing strong economic growth post-COVID this year, emerging market stocks tend to be highly cyclical in nature.

The weakening of the US dollar has made it easier for many emerging nations to borrow money and boost demand for their dollar-denominated exports.

The fact that stock valuations in the US have become “increasingly irrational” has also encouraged investors to look for opportunities elsewhere, especially in emerging markets.

It’s become increasingly difficult to ignore the strong performance and growth potential of emerging markets like China and India.

However, Morgan Stanley recently warned investors that the peak performance of emerging market equities might be behind us now.

Picking the Right Emerging Market ETFs

According to ETF Database, there are a total of 104 emerging market ETFs…so there is no shortage of them if you are looking for international diversification.

Most of the emerging market ETFs are market-cap weighted. But others use a variety of strategies such as sectors and themes to invest in emerging markets. These differences could lead to different returns for investors.

Here are the factors you must consider when picking the right emerging market ETF:

-

Assets Under Management (AUM)

Make sure the ETF you are thinking of investing in has at least $100 million in assets under management. An ETF with low AUM has limited investor interest.

The higher the better - a higher AUM enables ETFs to track their respective indices closely and have a higher trading volume. As a result, they have a tighter spread. For the uninitiated, spread is the gap between the bid and asking price. The lower the spread, the better.

-

The Underlying Index

Most emerging market ETFs track an index. The index provider follows pre-defined criteria to determine which countries and stocks will be part of the index. ETFs merely hold the same stocks in the same proportions as the underlying index.

For example, the Schwab Emerging Markets Equity ETF (SCHE), which tracks the FTSE All Emerging Index, has 1,607 stocks in its portfolio.

On the other hand, Vanguard FTSE Emerging Markets ETF (VWO) has invested in more than 4,000 stocks because it tracks a different index called the FTSE Emerging Index.

Here’s another interesting thing - VWO and SCHE track indices that exclude South Korea from the list of emerging markets.

South Korea is one of the world’s most developed countries. It doesn’t qualify as an emerging market.

However, the iShares Core MSCI Emerging Markets ETF (IEMG) lumps South Korea in with emerging markets because it tracks the MSCI Emerging Markets Investable Market Index.

-

Expense Ratios

ETFs give investors low-cost exposure to emerging markets. But some ETFs have unreasonably high expense ratios. Remember that returns are uncertain… but expenses are 100% certain and they eat into your returns. So, you want the expense ratios to be reasonably low.

For instance, the iShares MSCI Emerging Markets ETF (EEM) has a ridiculously high expense ratio of 0.68%.

That’s almost 7x higher than Vanguard FTSE Emerging Markets ETF (VWO)’s 0.1% annual expense ratio.

Even the iShares Core MSCI Emerging Markets ETF (IEMG) has a pretty low expense ratio of 0.11%.

-

Tracking Error

Tracking error is the difference between the performance of an ETF and its underlying index. Most emerging market ETFs closely track their underlying index.

An ETF should be tracking its underlying index as closely as possible, with minimal tracking error.

Now that you know how to pick the right emerging market ETF for yourself, it’s time to decide on asset allocation and start investing in emerging markets.