Over the last couple of decades, acronym investing has become a fad. Investors and fund managers looking for the next big growth opportunities in emerging markets turned to small groupings of countries that had a common economic concept. Thus came into existence acronyms like BRICS, MINT, and CIVETS.

The acronym BRICS (Brazil, Russia, India, China, and South Africa) was created by former Goldman Sachs economist Jim O’Neill in 2001. O’Neill also coined an acronym called the MINT (Mexico, Indonesia, Nigeria, and Turkey).

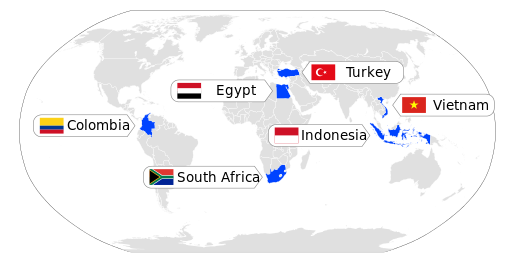

CIVETS is another acronym that caught the fancy of investors a decade ago. The Economist Intelligence Unit (EIU) coined the term in 2009. It includes Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa.

Each of these countries are located far away from each other. They are all different politically and culturally. The common thread tying them together is that they have a young and growing population, and a dynamic economy.

The CIVETS group has a young population, growing domestic markets, sophisticated financial systems, manageable inflation rates, and the potential to produce stellar returns. They also emphasize higher education, and their economies don’t rely heavily on commodity exports or external demand.

Despite the economic and political risks, emerging markets have been growing at least twice as fast as developed countries - and they are likely to maintain their robust growth. These countries also have relatively low public debt and household debt.

Former HSBC CEO Michael Geoghegan once referred to CIVETS as the “new BRICS”… but let’s set the fashionable acronyms aside and look at the countries - because it’s the individual markets that generate returns for investors, not the acronyms.

The CIVETS countries are much smaller than their BRICS counterparts. Indonesia is the largest of them with a nominal GDP of $1.08 trillion and a population of 270 million in 2020. Turkey has a population of 83.6 million and GDP of $794 billion. The annual GDP of the other four countries is in the range of $300 billion to $400 billion.

So, they don’t have the economic clout of BRICS. Neither do they have the potential to reshape the global economic order. Thankfully, investors don’t need a massive economy to earn outsized returns.

Each of these countries presents opportunities and risks. Let’s dive into them one by one:

Colombia

Colombia is still a small market, but it boasts stable macroeconomic conditions and its external debt is only 40% of the GDP. It also happens to be the third largest economy in Latin America. Colombia has witnessed a boom in oil and gas production, and the country’s long-term growth prospects are favourable.

Indonesia

Indonesia is the largest economy in the Southeast Asia region and is a member of G20. Its large population and growing domestic consumption have attracted investments from the United States, Japan, China, and other countries. Even during the COVID pandemic, Indonesia’s budget deficit was a manageable 6% in 2020. Its debt-to-GDP ratio is just under 30%.

Vietnam

Vietnam has emerged as a strong alternative to China as a low-cost manufacturing hub. The economic reforms implemented by the Communist Party have helped it become one of the fastest growing economies in the world. The government has been committed to higher education and research.

Egypt

The Egyptian economy is projected to grow 2.8% in 2021, according to the International Monetary Fund (IMF). In recent years, Egypt has reaped the benefits of an influx of tourists (prior to the pandemic), the discovery of natural gas fields, and growing remittances from people working abroad. However, political stability and religious tensions have been a concern.

Turkey

Turkey has benefited from its political stability and its relations with Western countries - but religious turmoil has affected its economic prospects. The Turkish Lira has been a highly volatile currency, falling as much as 15% against the US dollar in March 2021. Inflation has also been running sky high, making it an unattractive destination for investors.

South Africa

South Africa has the second largest economy in Africa after Nigeria. It has a well-developed infrastructure and is home to several large corporations. However, the country has been struggling with high unemployment and poverty rates. Its GDP growth rate was just 0.2% in 2019 and the economy contracted 8.2% in 2020 due to the COVID pandemic. The budget deficit widened to a staggering 14% last year.

Conclusion

Some countries in the CIVETS group have the potential for long-term growth and outsized returns. But others are still struggling with political instability, runaway inflation, high debt burden, and sky-high unemployment. Regulatory constraints and liquidity issues still haunt most of these countries.

So, CIVETS as a group is not as attractive as economists had hoped. If you want an exposure to the emerging markets, ETFs tracking the broader emerging markets are relatively better because they minimize risk and offer greater diversification. HSBC Global Asset Management launched a CIVETS fund in 2011 to invest in a diversified portfolio of equities from these six countries, but closed the fund in 2013 due to low AUM and limited growth.