Since its initial steps back in 1973, Javer, the Mexican homebuilder headquartered in Monterrey, has been featured for its prudent management of resources, with Mr. Salomón Marcuschamer at the helm. Early in the '00s, the Company began experiencing accelerated growth, propelled through its incursion into the affordable entry-level and middle-income housing segments and heightened by its ventures into the States of Jalisco, Aguascalientes, and Tamaulipas a few years later. Consequently, in 2007, consistent with its continued expansion, the Management decided to undergo a corporate restructuring process, leading to the establishment of Servicios Corporativos Javer, S.A.B. de C.V. as a holding company.

Until this point, Javer had primarily relied on bridge financing for working capital. This basically meant the Company had to secure a funding source for each project, an approach that eventually became increasingly expensive (due to the mix of fees and the velocity of deployment of projects) and harder to manage as the number of projects went up.

Keeping the above in mind, it was during the final two years of that decade when Javer really paved the road to reach its current standing as the #1 provider of INFONAVIT loans, given the three major milestones achieved during this span: 1) The subscription of a US$160 million Syndicated loan (2008); 2) the acquisition of controlling interest in Servicios Corporativos Javer by Southern Cross Group, Glisco Partners, and Arzentia Capital (2009); and 3) the issuance of senior unsecured notes for US$180 million in the international capital market (2009).

Why are these events so significant? Due to the domestic context. Between 2008 and 2009, the world was going through a severe economic recession caused by the US subprime mortgage crisis, so the financial environment was harsh. However, the solid push the Mexican government gave to the private housing sector at the time (according to the Los Angeles Times, the number of yearly mortgage loans granted by INFONAVIT went from slightly above 200,000 in 2001 to nearly 500,000 in 2008) set an ideal stage for its prominent players to thrive, as the smaller ones faced many difficulties securing financing. Thus, with funds and a clear path to keep building and titling housing developments, Javer remained on the growth track.

Shedding some color on the Company's financials and liability management, the US$180 million senior unsecured notes had a 13% coupon, a 5-year term, and a single amortization at the maturity date. The issuance was the first one by a Mexican non-investment grade issuer since the beginning of the crisis, boasting the participation of over 50 global investors and evidencing the market's confidence in the Mexican housing sector and Javer (which allowed for a USD$30 million reopening at the same rate the following year).

The proceeds were used to refinance 100% of the outstanding balance of the syndicated loan and to pay off the financial obligations of Javer's parent company, Proyectos del Noreste. Hence, Javer went from a total debt of Ps.2.1 billion (83% belonging to the syndicated loan) with a Total Debt to LTM EBITDA of 1.93x and EBITDA interest coverage of 3.75x in 2Q09 to Ps.2.7 billion in 3Q10, with ratios of 3.13x and 2.46x, respectively.

Then, on March 18, 2011, Javer initiated a debt exchange whereby 2014 noteholders were encouraged to exchange their 2014 notes for an 18% premium and new 2021 Notes with a 9.875% coupon, validly tendering and exchanging 97%, while also issuing another US$30 million in 2021 notes (adding up 2021 Notes reached US$320 million). Javer closed 1Q11 with a total debt of Ps.2.6 billion with ratios of 2.65x and 2.85x in Total Debt to LTM EBITDA and EBITDA interest coverage, respectively.

The next big step for Javer funding-source-wise (after a US$50 million reopening of the 2021 notes in 2013) came on January 12, 2016, the date of its IPO. Placing an equivalent to 34.0% of the outstanding shares among the investing public, for Ps.1,800 million, Javer allocated the resources to prepaying US$136 million of the 2021 Senior Notes, leaving the outstanding amount in US$159 million and the debt ratios at 2.44x and 2.01x (total debt as of 1Q16 was Ps.2.6 billion).

With this, Javer significantly lowered interest payments pushed up by the weakening peso, and kept working on different alternatives to refinance the remaining part of the 2021 notes (properly hedged to prevent value leakage) to get rid of the FX exposure. Such was accomplished in November 2019 when the Company received Ps.2,745 million (87%), and US$21 million (13%) from a syndicated credit contract signed a few months earlier, successfully reducing the total weighted cost of the new debt by 120 basis points compared with the hedge cost of the 2021 notes.

Despite the syndicated loan had to be restructured in 2021 (postponing a fraction of the quarterly amortizations to allow for capital raising efforts) as the Company was no stranger to the effects of the pandemic, Javer once again honored its creditor's trust by voluntarily early settling such loan on the past November 14th (following an advance payment of Ps.500 million in February of this year).

In this sense, in keeping with its endless pursuit to strengthen its capital structure, Javer signed a syndicated loan (with Banco Santander as lead arranger) for an amount of up to Ps.2,450 million, maintaining the guarantee scheme of the previous loan and improving the Company's maturity profile (extended to 2027 from 2024) and financial conditions (savings of approximately 250 basis points in the interest rate).

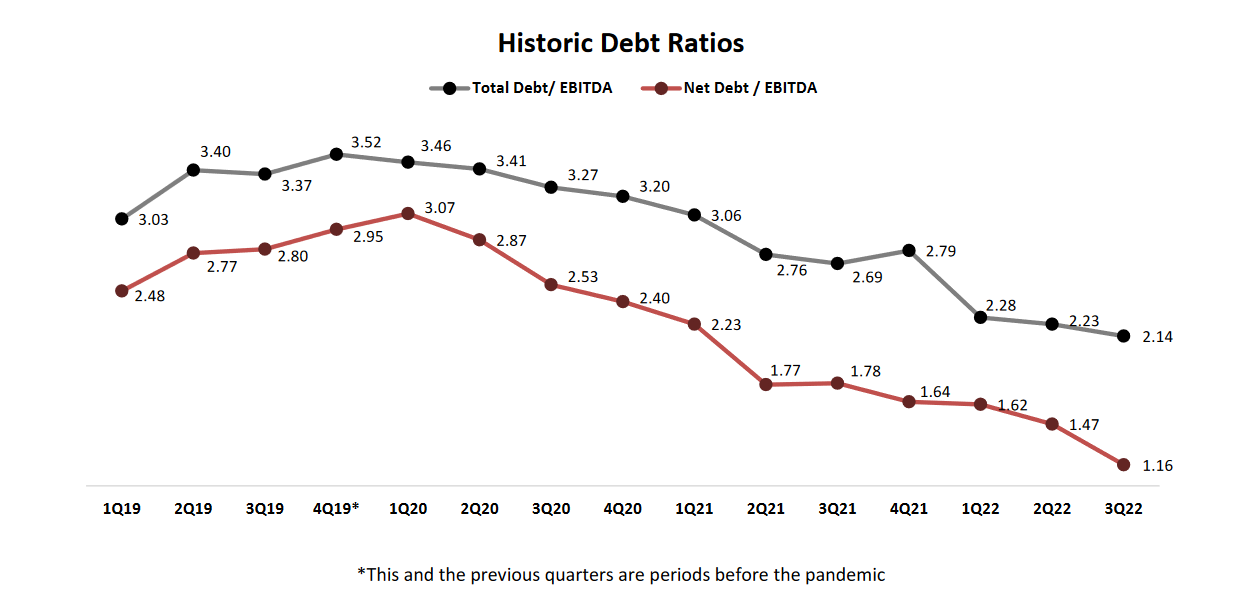

As depicted in the graph below and reviewed above, Javer has been consistent with the threshold it deems appropriate for its debt ratios while constantly striving to enhance its financial conditions, making it a worthwhile option to follow if you are seeking to bolster your capital portfolio, when the company taps into the markets again sooner or later.