Ever-increasing inflation is an undeniable truth. Rather than only trying to reduce your expenses, an investor should also look for opportunities to profit from inflation. The Reserve Bank of India, the local central bank, has fixed a 2-6% range of consumer inflation before it acts, but actual inflation hitting your pocket can be much higher. An average investor can profit from inflation by investing in stocks which have strong branding power, meaning consumers may willingly pay high prices without affecting demand.

Below are four Indian consumer stocks which you can own to profit from increasing inflation. These companies have proved resilient and increased their turnover in the face of a recession, pandemic, and shifts in the business cycle. These stocks have been selected based on their branding power, consistency of business growth, strong balance sheet, and superior market return.

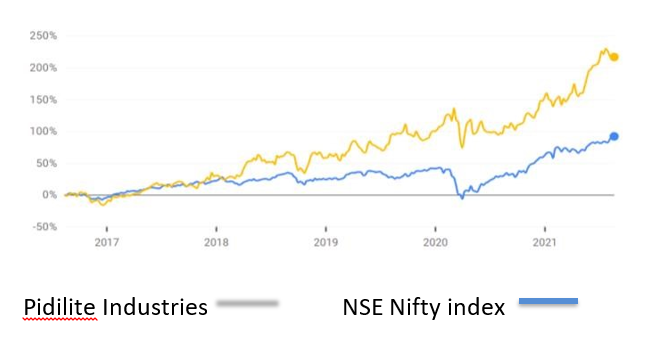

Hindustan Unilever Limited

Hindustan Unilever (NSE: HINDUNILVR) is the largest player in the packaged consumer goods industry in India. The company has built market-leading brands in the home care, beauty, personal care, and food segments. Hindustan Unilever spends over 10% of its revenue on advertising and brand building, and has fourteen brands generating an annual turnover of over 1,000 crores. During its last fiscal year, the company increased its turnover and net margin by 18%. This stock also offers investors a strong dividend yield of 1.68%. During the last five years, the stock has given a return of 166% against the market benchmark return of 91% during the same period.

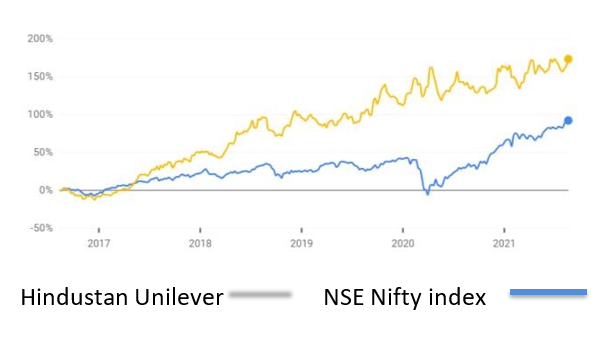

Tata Consumer Products Limited

Tata Consumer Products Limited

Tata Consumer Products (NSE: TATACONSUM) is a market leader in the natural beverages segment: tea, coffee, and water. Many of the company’s consumer brands rank in the top-five list, including brands like Tetley and Eight O’Clock Coffee, which rank on top-five lists in the UK, USA, and Canada. Tata Consumer Products has increased its revenue over the last 10 years with a CAGR OF 13%. During these years, the company has built a strong balance sheet with huge cash reserves and is almost debt-free. During the last five years, the stock has returned 468% against the market benchmark return of 91% during the same period.

Asian Paints Limited

Asian Paints (NSE: ASIANPAINT) is a market leader in the decorative paint segment in India with a market share of around 39%. The company has consistently increased its turnover during the last ten years at 8.8% CAGR. During FY 2020-21, it had an EBITDA margin of 26%. Even though the stock trades at a P/E of 83.11, the company has a strong balance sheet to fund business growth. Asian Paints is debt-free and has tripled its earning per share over the last ten years. The company reported EPS of Rs. 32.7 during its last fiscal year. During the last five years, its stock outperformed the market index by delivering a 171% return against a benchmark return of 91% during the same period.

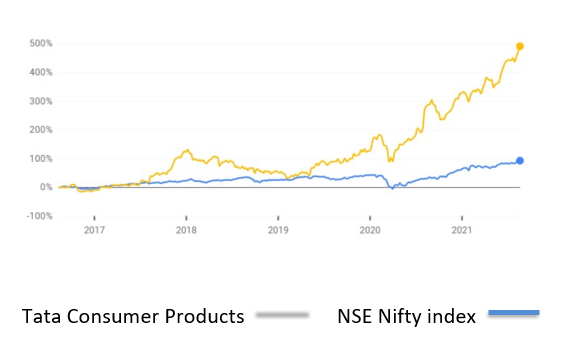

Pidilite Industries Limited

Pidilite Industries (NSE: PIDILITIND) is a market leader in adhesives and glues with around 70% market share. The company derives 82% of its business from the ‘high-margin’ consumer segment and has built strong brand awareness in the adhesive segment on the back of sustained advertising. Pidilite Industries believes in product innovation and having first-mover advantages like introducing fabric glue, craft, and hobby product range. During the last ten years, the company managed to triple its earnings at Rs 1,081 crores. They earned Rs 21.3 on a per share basis and are almost debt-free. During the last five years, its stock outperformed the market index by delivering 216% return against a benchmark return of 91% during the same period.