India, a developing country with the second largest population in the world (read: a lot of consumers) and amongst one of the fastest-growing economies in the world, is an excellent bet and deserves to be a part of your global portfolio.

Let’s look at some reasons why:

• GDP growth: According to Moody’s Analytics we can expect India’s growth to be 12.6% in FY2022. There is no other country that is expected to grow that fast and bounce back after the pandemic. The GDP of India is expected to grow from $2.6 trillion in 2020 to $3.9 trillion by 2025 - that is a compounded annual growth rate of 8.45%. If you’re successful in finding companies that grow 1.5-2 times the GDP rate, the amount of wealth you can create is phenomenal.

• Demographics: India is amongst the few nations to have a median age of 28 years. India has close to 48% of its population under the age of 21 years; in the coming decade when these people start contributing to the economy, imagine how fast India will grow. The more these people earn, the more consumption is going to rise - giving companies phenomenal opportunities to make money. As an investor, you can’t afford to miss this opportunity.

• Higher Disposable Income: As more people come under the working-class bracket, incomes are likely to rise. This has a money multiplier effect as better income leads to more aspirations, which leads to a better standard of living, which ultimately leads to a lot of spending in the economy.

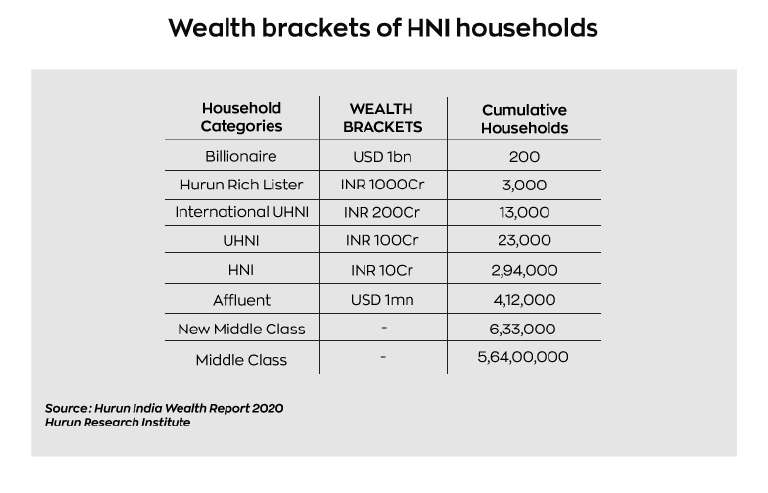

• Rising Middle Class: Middle class in the below image is defined as those having annual earnings of more than 2.5Lacs and a net worth of fewer than 7 crores - the number is 564,000. This is the elephant in the room; when these move, the growth in India would be unstoppable. Investing in businesses that capture this movement is likely to make investors a lot of money.

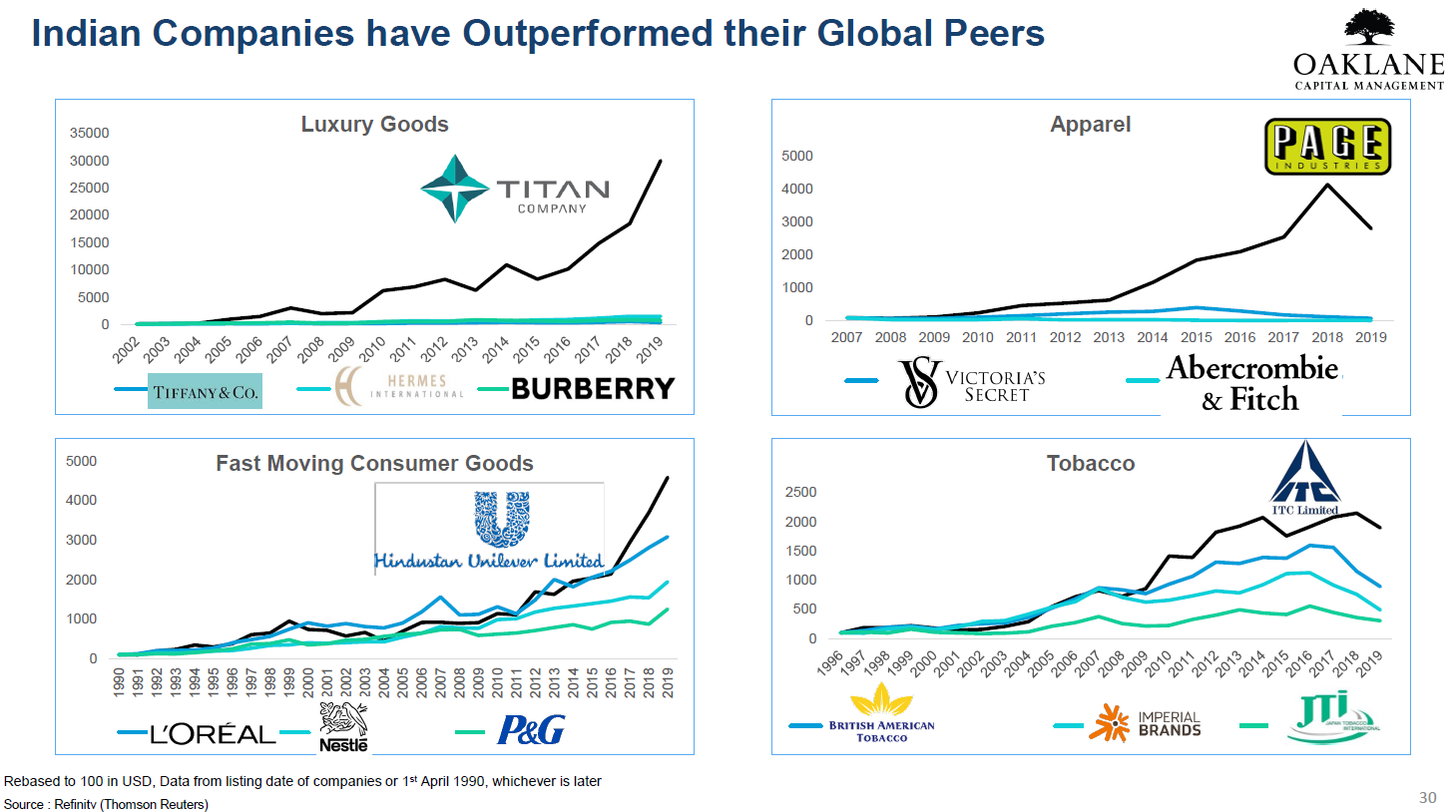

Here are few examples of wealth creation that has happened in India in the past compared to global peers:

Source: Oaklane capital, Kuntal Shah

• Longevity: In the stock market, longevity (i.e. the number of years a company can keep on growing) is one of the most important factors… and in India, due to favourable demographics, rising income. etc. longevity is very high. This gives Indian companies an edge over global peers in the west where the population is aging.

To sum it up, apart from obvious reasons like diversification, investing in India is an opportunity that you as an investor should not miss. The Sensex, a 30 stocks index by Bombay Stock Exchange, has given around 12.36% annual return for the past 41 years. Its value has gone from 413.53 on April 1, 1980 to 50,029.83 as of April 1, 2021.

Even if you invest in index ETF’s, you could compound your money at a 12-14% rate consistently for coming decades. To put it into perspective, $100,000 grown at 12% would give you $1,120,000 and at 14% it would be $ 3,707,221.

Disclaimer: Anything mentioned above should not be construed as an investment adviser. This article is for informational purposes only. Please consult your financial advisor before making any decision.